main street small business tax credit self-employed

A qualified small business employer is a taxpayer who meets the following requirements. 1666 Main Street Springfield MA 01103 413-272-2209.

22 Money Saving Small Business Tax Deductions 2022

MainStreet takes a holistic approach to small business management so you can grow your business smarter not harder.

. Visit Instructions for FTB 3866 for more information. Had a 50 decrease in income tax gross. An Economic Injury Disaster Loan EIDL can provide up to 2 million to small businesses impacted by the coronavirus shutdown.

Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit. Free means free and IRS e-file is included. The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers.

On November 1 2021 the California Department of Tax and Fee. The Main Street Small Business Tax Credit II will provide COVID-19 financial relief to qualified small business employers. Employed 500 or fewer employees as of December 31 2020 and.

Ad Our Easy Step-By-Step Process Takes The Guesswork Out Of Filing Self-Employed Taxes. Buy an existing business or franchise. We will be accepting online applications to reserve tax.

Economic Injury Disaster Loan. Find Small Business Expenses You May Not Know About And Keep More Of The Money You Earn. Start Your Tax Return Today.

To claim a general business credit you will first have to get the forms you need to claim your current year business credits. Resources for taxpayers who file Form 1040 or 1040-SR Schedules C E F or Form 2106 as well as small businesses with assets under 10 million. Max refund is guaranteed and 100 accurate.

This bill provides financial relief to qualified small businesses for the economic. Lenders and other community groups that help small businesses succeed. Employed 500 or fewer employees as of December.

Business Licenses Permits. The Main Street Small Business Tax Credit is a bill that provides financial relief to qualified small businesses for the economic disruptions in 2020 and 2021 that caused massive financial. Read customer reviews find best sellers.

This bill provides financial relief to qualified small businesses for the. Had 100 or fewer employees on December 31 2019. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more.

The 2021 Main Street Small Business Tax Credit II will provide COVID19 financial relief to qualified small business employers. The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers. Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II.

The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers. The amount is 1000 for each net increase in the qualified employees measured after the monthly full-time. Division of Professional Licensure.

Include your Main Street. Ad All Major Tax Situations Are Supported for Free. Browse discover thousands of brands.

The PPP provides forgiveness for small business loans for keeping employees. In addition to the credit form in most cases you may. Self-Employment copy of Federal Tax Return from previous year Schedule An Appointment.

On November 1 2021 the California Department of Tax and Fee. Credit Amount For California Main Street Small Business Tax Credit.

Six Tax Time Tips For Small Business Tax Time Small Business Tax

J K Lasser S Small Business Taxes 2022 Your Complete Guide To A Better Bottom Line Wiley

Tax Services Tax Services Income Tax Return Accounting Services

How Taxes Work For Small Business Owners In Canada Arrive

Impact Of Taxes On Small Business

New Listing 700 000 7 200 Sq Ft Formerly Known As Tappers Ale House With Full Bar Restau Carlton Landing Lakeside Restaurant Restaurant Bar And Grill

To Save Their Neighborhood Small Businesses People Are Rebelling Against Delivery Apps The Neighbourhood Estate Planning Attorney Local Businesses

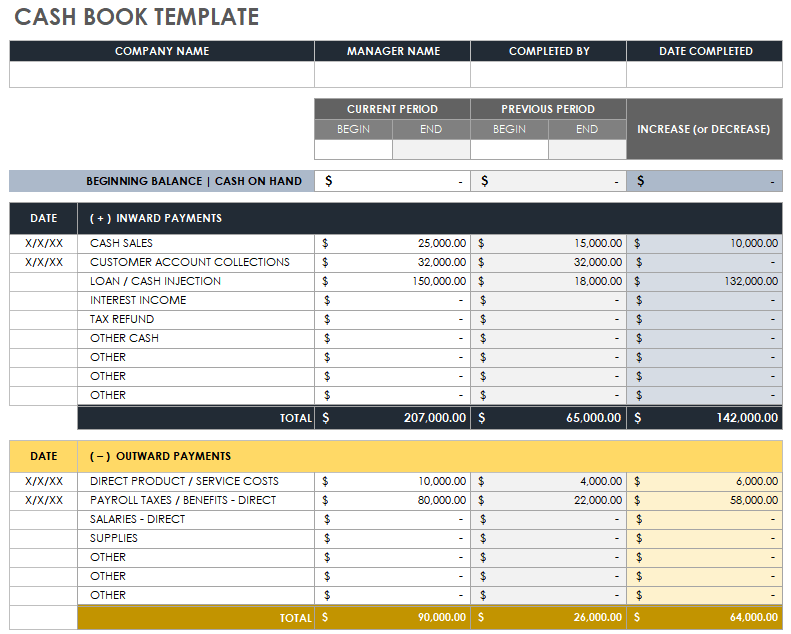

Free Small Business Bookkeeping Templates Smartsheet

How To Get Your Letter Of Interest Noticed By A Company Lettering Cover Letter Design Writing A Bio

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Typical Purchase Invoice Template With Bill To And Ship To Information Invoice Template Word Microsoft Word Invoice Template Invoice Template

Resume Examples Accounts Payable Resume Templates Job Application Cover Letter Cover Letter For Resume Resume Examples

How To Track Your Small Business Expenses 4 Easy Tips

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

How To Get A Small Loan Business Plan Ideas Of Tips On Buying A House Buyinghouse Business Plan Template Word Business Plan Outline Startup Business Plan

Business Tax Deadline In 2022 For Small Businesses

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog